Coachability

The startup superpower building enduring companies

Happy Thursday, 👋

Listen to any group of investors at a pitch event and you’ll eventually hear someone mention whether a particular founder is coachable. It’s a common topic that often surfaces as a deciding factor for why investors choose to consider or pass on an opportunity. The perception of coachability can carry as much weight as market size or traction because investors know they are signing up for a multi-year journey alongside the founder. On that journey, adaptability and collaboration often prove more valuable than raw intelligence or credentials.

Why Coachable Founders Matter

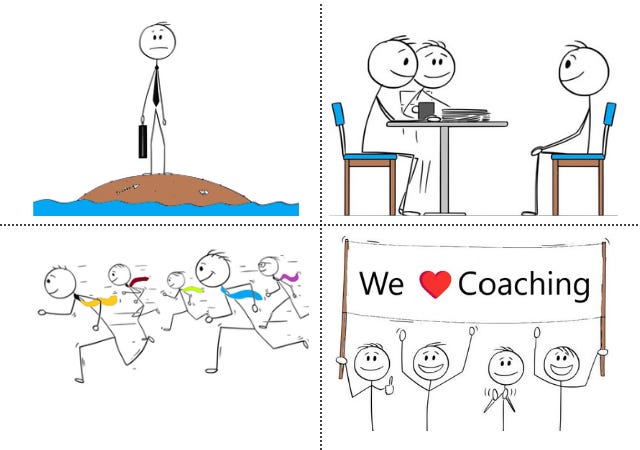

Venture investments are long-term partnerships. Once the capital is deployed, both founders and investors are tied together for years, sometimes a decade or more. During that time, startups evolve, markets shift, and strategies pivot. The ability for a founder to accept feedback and adjust course can determine whether the company grows or stalls.

Early-stage companies don’t have the luxury of large teams or armies of consultants. Founders must maximize every available resource, including their investors. The best founders understand that experienced investors are not there to control the business but to offer perspective, pattern recognition, and connections that can accelerate growth. Coachable founders create a dynamic where investors want to contribute beyond their capital.

What Makes a Founder Coachable

Coachable founders are confident enough to recognize where they excel and where they need help. They’re willing to consider alternate approaches without feeling threatened by them. Being coachable does not mean blindly following every suggestion, it means evaluating input with curiosity rather than defensiveness.

Think of it like a sports team. Players on the field see the game up close; they feel the momentum and make real-time adjustments. The coach, standing on the sidelines, has a broader view of the strategy and long-term plan. Both perspectives matter, and the best outcomes happen when they work together. Founders and investors share that same dynamic. The founder is in the trenches, and the investor provides a wider lens. Coachable founders know how to integrate both viewpoints.

What a Coachable Founder Is Not

A founder who debates every suggestion or dismisses feedback may believe they are showing strength and conviction. Often it comes across as insecurity or unwillingness to consider alternative perspectives. There is a difference between rejecting an idea outright and explaining why something has not worked in the past while still being open to considering it from a different perspective.

On the other end of the spectrum, overreacting to every new idea can be just as damaging. Coachability does not mean chasing every shiny object or trying every piece of advice. The goal is to filter feedback, understanding what aligns with the company’s mission and what does not. A thoughtful founder iterates deliberately, not constantly pivoting. Investors look for founders who calmly evaluate input, integrate the useful ideas, and maintain the integrity of their vision.

Becoming a Coachable Founder

True coachability requires humility paired with confidence. It means being secure enough to admit when you may not have all the answers while still believing in your ability to figure them out. Even elite athletes rely on coaches to stay at the top of their game because they understand the value of multiple perspectives in the pursuit of excellence. Founders should adopt that same mindset, remaining open to learning and evolving at every stage.

The process starts with listening to understand. It’s often the hardest part of the process, sitting through feedback without trying to interrupt, defend, or rationalize. Coachable founders listen, then ask clarifying questions and seek the reasoning behind feedback rather than arguing each point. The best founders evaluate input objectively, extracting what strengthens the company and filtering out the rest. They treat feedback as data, not directives.

Coachable founders also build consistency into their approach. They do not wait for moments of crisis to seek advice; they embed feedback loops into their culture. They invite team members, advisors, and investors to challenge assumptions. This openness fosters trust, accountability, and a culture of continuous improvement.

Final Thoughts

Research shows that certain nonverbal cues such as nodding, smiling, or maintaining eye contact during feedback often signal coachability. While founders should not force these behaviors, investors can use them as subtle indicators of openness. The key is that coachability is visible. It shows up in tone, posture, and how someone follows up after receiving feedback.

Ultimately, venture investing is a team sport. Founders and investors share the same objective: building a successful company. History is filled with examples of teams overflowing with talent that fell short because they could not work together or felt they did not need coaching. Even the most gifted individuals cannot win if they are not open to continuous improvement and feedback.

The founders who endure and succeed are not just visionary, they are coachable. They understand considering alternative perspectives does not weaken their leadership, it strengths it. In the long run, it’s not vision alone that builds enduring companies, it’s the humility to evolve and remain coachable.

Wishing everyone a great weekend,

-Eric.